Embedding ESG into the Bank's Activity

Our ESG

ENVIRONMENT

SOCIAL

GOVERNANCE

Waste management

Electricity, heat, water consumption

Paper and eco material usage

Our environmental impact

Using non-toxic materials

Optimization of workplaces

Implementing electronic workflow

Implementing "Green Office"

Our bank's purpose is to help develop sustainable economies and empower people to build a better future. In order to reach this purpose we have assessed the social and environmental impact resulting from our activities and products.

Starting from 2019, the bank is implementing the "Green Office" principle in its activities— the use of non-toxic materials in office premises, energy efficiency, optimization of workplaces, as well as reduction of paper workflow; this has allowed the Bank to reduce its own consumption of natural resources.

In 2020, the Bank converted a significant portion of document flow, both internal and external into electronic format using 1C:Document management, Dialog, online-banking.

Since we are aimed to increase the positive impact and reduce the negative one, we implement all three dimensions of responsible banking into business decision-making at strategic, portfolio, and transaction levels.

Starting from 2019, the bank is implementing the "Green Office" principle in its activities— the use of non-toxic materials in office premises, energy efficiency, optimization of workplaces, as well as reduction of paper workflow; this has allowed the Bank to reduce its own consumption of natural resources.

In 2020, the Bank converted a significant portion of document flow, both internal and external into electronic format using 1C:Document management, Dialog, online-banking.

Since we are aimed to increase the positive impact and reduce the negative one, we implement all three dimensions of responsible banking into business decision-making at strategic, portfolio, and transaction levels.

Impact & Responsibility

1

2

3

1

2

3

Training and development

Health and safety

Human Rights

Contributing to Human Capital Development

Supporting education

Supporting local communities

Charity

Impact on society

The Bank pursues charity work in several socially important spheres supporting projects in education, art and creativity, empowering multicultural relations in the region, social protection of disabled people, the poor, and other socially vulnerable communities. We actively contribute to regional environment protection and wellbeing.

In 2020 the bank's charity fund supported 21 non-profit organizations in the following priority areas:

• Support of youth projects - promotion of the volunteer movement. Volunteer School;

• Supporting art and cultural projects by funding the local events.- Contribution to interethnic harmony – funding activities aimed to strengthen regional ethnic cultures: Bashkirs, Tatars, Russians, Gypsies, Mordovians, Georgians, etc.;

• Supporting all categories of vulnerable citizens – people with disabilities, orphans, low-income families, etc.;

• Contributing to urban and environmental projects.

Funds allocated to charity: + 8% In 2020 compared to 2019

Accessibility of services for people with limited mobility: 100 % of the Bank's offices are equipped with a staff call button

In 2020 the bank's charity fund supported 21 non-profit organizations in the following priority areas:

• Support of youth projects - promotion of the volunteer movement. Volunteer School;

• Supporting art and cultural projects by funding the local events.- Contribution to interethnic harmony – funding activities aimed to strengthen regional ethnic cultures: Bashkirs, Tatars, Russians, Gypsies, Mordovians, Georgians, etc.;

• Supporting all categories of vulnerable citizens – people with disabilities, orphans, low-income families, etc.;

• Contributing to urban and environmental projects.

Funds allocated to charity: + 8% In 2020 compared to 2019

Accessibility of services for people with limited mobility: 100 % of the Bank's offices are equipped with a staff call button

Empowering people and communities

1

2

3

1

2

3

A complaint management system and careful attention to our clients' needs represent an essential tool for fostering long-term client relationships.

We create synergies with customers and clients and contribute to the common goals of the society. We push further sustainable practices in our own business and help our clients to apply ESG principles in their businesses and lifestyle.

A customer is not just a consumer of our services but above all a partner. The future of the bank depends on the future of our client.

We aim to offer versatile and seamless services so that our clients can focus on their business without any distractions related to banking issues.

We carefully monitor feedback from our customers and constantly improve the quality of our products and services.

We create synergies with customers and clients and contribute to the common goals of the society. We push further sustainable practices in our own business and help our clients to apply ESG principles in their businesses and lifestyle.

A customer is not just a consumer of our services but above all a partner. The future of the bank depends on the future of our client.

We aim to offer versatile and seamless services so that our clients can focus on their business without any distractions related to banking issues.

We carefully monitor feedback from our customers and constantly improve the quality of our products and services.

Client Relationships

We believe that the basis of sustainable banking is to care about the future and focus on innovations and technology, and that's why we contribute to the local educational system, especially when it comes to school education.

KIBERone school in Ekaterinburg, which rents part of the bank's building, felt financially squeezed due to the pandemic, and the bank has offered a 35 percent discount on a permanent basis.

This is the largest international school in the sphere of digital education for children aged 6 to 14, which operates in 20 countries and more than 150 cities.

The school has many international awards and showcases a truly innovative approach.

KIBERone school was recognized as the best educational institution of 2018 on the territory of the EU. It teaches kids and teenagers computer programming and creating their high-tech projects.

KIBERone school in Ekaterinburg, which rents part of the bank's building, felt financially squeezed due to the pandemic, and the bank has offered a 35 percent discount on a permanent basis.

This is the largest international school in the sphere of digital education for children aged 6 to 14, which operates in 20 countries and more than 150 cities.

The school has many international awards and showcases a truly innovative approach.

KIBERone school was recognized as the best educational institution of 2018 on the territory of the EU. It teaches kids and teenagers computer programming and creating their high-tech projects.

Contributing to the local educational system

Strategy and governance

Risk management

Monitoring and control mechanisms

Corporate Governance

Ensuring data security

Preventing unfair sales

Considering interests of all shareholders

Security

Our goal is to maximize the benefits to individuals and society and minimize the risks. The Bank supports activities that are fully in line with the law.

We design and implement a successful approach to responsible banking and ESG. Our bank ensures a bespoke performance due to sufficient internal resources and ESG data.

In the context of current global challenges, the concept of sustainable development is becoming increasingly important.

We face an emerging global trend to form new business approaches to managing risks, resources, and all types of impact on the economy, society, and the environment.

Russia is also actively forming a strategy combining economic efficiency, social justice, and environmental safety.

We design and implement a successful approach to responsible banking and ESG. Our bank ensures a bespoke performance due to sufficient internal resources and ESG data.

In the context of current global challenges, the concept of sustainable development is becoming increasingly important.

We face an emerging global trend to form new business approaches to managing risks, resources, and all types of impact on the economy, society, and the environment.

Russia is also actively forming a strategy combining economic efficiency, social justice, and environmental safety.

Alignment

1

2

3

1

2

3

Our bank supports the government program for small businesses. We consult small companies and help them to receive bank guarantees and loans for developing their business.

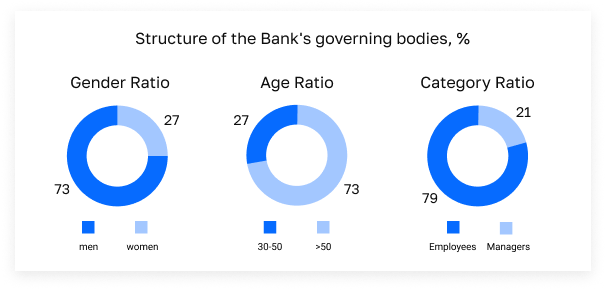

The Board of Directors transmits the ESG issues and objectives to all management levels.

Our professionals offer responsible banking services tailored to all kinds of needs and levels of awareness.

Our banking activity's core values are protecting morality and life, family, intellect, and wealth.

PERVOURALSKBANK's top management pays special attention to the sustainability agenda and implementation of ESG principles into the Bank's strategic planning and operations. We are aware of the utmost importance of ESG principles in the development of the financial sector.

The Board of Directors transmits the ESG issues and objectives to all management levels.

Our professionals offer responsible banking services tailored to all kinds of needs and levels of awareness.

Our banking activity's core values are protecting morality and life, family, intellect, and wealth.

PERVOURALSKBANK's top management pays special attention to the sustainability agenda and implementation of ESG principles into the Bank's strategic planning and operations. We are aware of the utmost importance of ESG principles in the development of the financial sector.

Transparency & Accountability

The bank ensures the interests of all shareholders, regardless of the size of their share in the authorized capital.

The following procedures foster the bank's corporate practices:

• Realizing the members' rights in full compliance with the legislation of the Russian Federation

• All shareholders and potential investors can interact with the bank in any available format.

• Full disclosure of information.

We proactively and responsibly consult, engage and partner with relevant stakeholders to achieve society's goals. As part of this strategy we carefully choose the partners and stakeholders relevant to our goals and values.

The bank's indicators demonstrate the progress in sustainable development goals.

We focus on collaboration and environment-friendly practices to ensure progress in sustainable banking.

The bank is aimed at long-term relationships with its partners and clients.

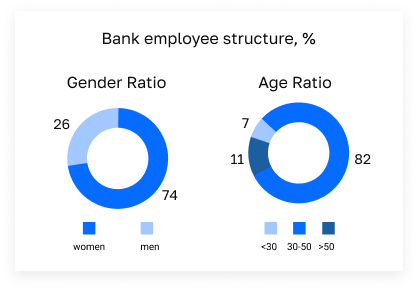

We provide professional and personal development opportunities and are committed to observing human rights in all our activities.

The bank constantly improves human capital management processes, creates an adaptive and comfortable environment for employees, and provides opportunities for professional and personal development. The Bank strictly observes human rights in its activities.

The following procedures foster the bank's corporate practices:

• Realizing the members' rights in full compliance with the legislation of the Russian Federation

• All shareholders and potential investors can interact with the bank in any available format.

• Full disclosure of information.

We proactively and responsibly consult, engage and partner with relevant stakeholders to achieve society's goals. As part of this strategy we carefully choose the partners and stakeholders relevant to our goals and values.

The bank's indicators demonstrate the progress in sustainable development goals.

We focus on collaboration and environment-friendly practices to ensure progress in sustainable banking.

The bank is aimed at long-term relationships with its partners and clients.

We provide professional and personal development opportunities and are committed to observing human rights in all our activities.

The bank constantly improves human capital management processes, creates an adaptive and comfortable environment for employees, and provides opportunities for professional and personal development. The Bank strictly observes human rights in its activities.

Governance & culture

"Every time a bank has met a target it will need to re-examine its impacts and then set a more ambitious target"

Christopher Marchant

THE WIDESPREAD ERADICATION OF POVERTY IN ALL ITS FORMS

ENSURING HEALTHY LIFESTYLES AND PROMOTING WELL-BEING FOR ALL

ENSURING INCLUSIVE AND EQUITABLE QUALITY EDUCATION AND PROMOTING LIFELONG LEARNING OPPORTUNITIES FOR ALL

ENSURING GENDER EQUALITY AND EMPOWERMENT OF ALL WOMEN AND GIRLS

ENSURING AVAILABILITY AND SUSTAINABLE USE OF WATER RESOURCES AND SANITATION FOR ALL

ENSURING UNIVERSAL ACCESS TO AFFORDABLE, RELIABLE, SUSTAINABLE ENERGY FOR ALL

PROMOTE SUSTAINABLE AND INCLUSIVE ECONOMIC GROWTH, FULL AND PRODUCTIVE EMPLOYMENT AND DECENT WORK FOR ALL

BUILDING RESILIENT INFRASTRUCTURE, PROMOTING INCLUSIVE AND SUSTAINABLE INDUSTRIALIZATION AND INNOVATION

REDUCING INEQUALITIES WITHIN AND BETWEEN COUNTRIES

ENSURING OPENNESS, SAFETY, RESILIENCE AND ENVIRONMENTAL SUSTAINABILITY OF CITIES AND TOWNS

ENSURING TRANSITION TO SUSTAINABLE CONSUMPTION AND PRODUCTION PATTERNS

TAKING URGENT MEASURES TO COMBAT CLIMATE CHANGE AND ITS CONSEQUENCES

PRESERVING TERRESTRIAL ECOSYSTEMS

peace, justice and strong institutions

STRENGTHENING MEANS OF IMPLEMENTATION AND REVITALIZING THE GLOBAL PARTNERSHIP FOR SUSTAINABLE DEVELOPMENT.

ESG

- Increasing the availability of financial services in the regions of presence, including the basic financial services, development of channels and service infrastructure in the regions of presence.

- Participation in projects in the field of financial literacy.

- Participation in charitable projects aimed at supporting vulnerable groups of population.

- Supporting the elderly population through the provision of special financial products.

- Supporting groups of people with low mobility by creating an accessible and barrier-free environment in our bank's offices.

- We support rational use of water resources.

- Promoting sanitation and hygiene education, in particular, during the pandemic.

- Separate waste collection.

- Collection and recycling of hazardous waste.

- Recycling of paper waste.

- Provision of health care financing (leasing of medical equipment).

- We are providing financial risk protection services.

- Full-scale intervention during a new coronavirus pandemic to protect the health of employees and clients and their families.

Supporting small- and medium-sized businesses in the regions where we operate. Funding transport infrastructure development, SME support in single-industry towns.

We are constantly improving our own energy efficiency.

PROMOTING PEACEFUL AND OPEN SOCIETIES FOR SUSTAINABLE DEVELOPMENT, PROVIDING ACCESS TO JUSTICE FOR ALL, AND BUILDING EFFECTIVE, ACCOUNTABLE, AND PARTICIPATORY INSTITUTIONS AT ALL LEVELS

- Following the principles and requirements for combating corruption and fraud, money laundering, and terrorist financing.

- Implementing a set of measures to protect personal data based on GDPR regulations.

- Actively participating in the process of improving banking regulations.

- We actively cooperate with educational institutions in implementing educational, scientific, and practical and research projects.

- We actively implement internal training programs for employees.

- Improving the bank's own resource and energy management system.

- Reducing waste generation through separate waste collection.

- Introducing an electronic document management system for customers relations and for internal corporate interaction.

- Collection of used batteries and recycling of paper waste.

- Creation of new jobs in the regions where we operate.

- Supporting business development through the provision of financial services, including debt restructuring for borrowers affected by the COVID-19 pandemic.

- Supporting the internal productivity projects.

- Transparent interaction with stakeholders.

- We are developing the collection of non-financial information, including the first publication of a report incorporating ESG and sustainability elements.

- Interaction with public authorities, associations on issues related to ESG aspects.

- We are creating equal working conditions and career opportunities.

- We ensure women's active participation in management processes at all levels of decision-making.

- The bank carefully revises approaches to performance appraisal and remuneration.

Reducing CO₂ emissions

- Building and maintaining our own infrastructure in the regions where we operate.

- We are foster the digitalization of the economy. We are introducing the robotization of the Bank's processes.

- Supporting projects aimed at the development of modern technologies in the banking sector.

- Full-scale application of remote work and videoconferencing in the workplace during the COVID-19 pandemic.